20 November 2025

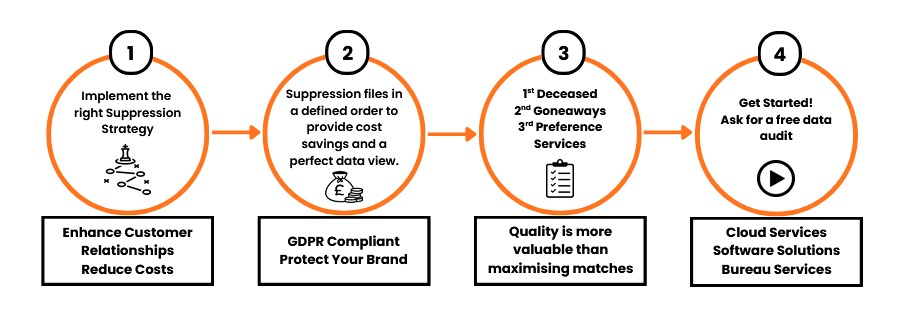

Maintaining clean and accurate data is crucial for effective communication, compliance, and cost-efficiency. Data suppression helps you identify and manage records that are outdated, incorrect, or no longer relevant.

Data suppressions involve comparing your customer data against trusted external sources to flag or remove:

The right suppression strategy can bring a number of benefits:-

There are a number of important questions companies should consider when evaluating their data suppression strategies.

If it’s been more than three years since your last suppression evaluation you should schedule a review. It’s important to check that your current strategy is still achieving its objectives or whether improvements and changes need to be made.

Do you use a third party, and if so can you rely on them to implement the right suppression file and in the right order?

Many companies rely on the services of trusted data partners to implement and maintain their customer database or system. It is important to understand the decisions that were made to create your suppression strategies and when they were last reviewed. With a range of suppression files available it is best to do a comparison of all the deceased and goneaway suppression files available in the market today as new files enter the market and existing products change over time.

If you do rely on a third party, can you be certain they are providing you with a comprehensive solution that meets your requirements and complies with GDPR?

The use of suppression files is usually paid for on a ‘per hit’ basis. This means some suppression list companies make more money by finding as many goneaway and deceased records as they can. So it is important to get the order of matching right.

Hopewiser has spent more than 40 years in the data cleansing market and has created routines which make clear and obvious matches, but also allow some leeway for misspellings, whilst not making matches that are ‘fuzzy’. Alongside this, Hopewiser uses the suppression files in a defined order, using multiple sources, to give the best chance possible of cleaning the data.

The deceased files are checked first, because people can move towards the end of their life, but if they have died, then there is no point trying to find out where they have moved to. Goneaways are verified next, along with potential forwarding address information and finally, any mailing preferences are checked. The files are checked in a standard order to minimise the cost to the client, but this can be amended, if certain data has more relevance. For Hopewiser the quality of the match is always more important than maximising the number of matches.

The aim is to give you a perfect view of your data and offer a range of cloud based, stand-alone software, integrations and bureau services.

Hopewiser offers a range of solutions to cleanse and validate your data:

Ready to improve your data quality? Contact Hopewiser for a free data quality audit and discover how our suppression services can benefit your organisation.

You're in good company

We can restore your address lookup instantly with a like-for-like replacement.

Contact us to be up and running today!